Exporting RDF Could Get Dearer

03 July 2019

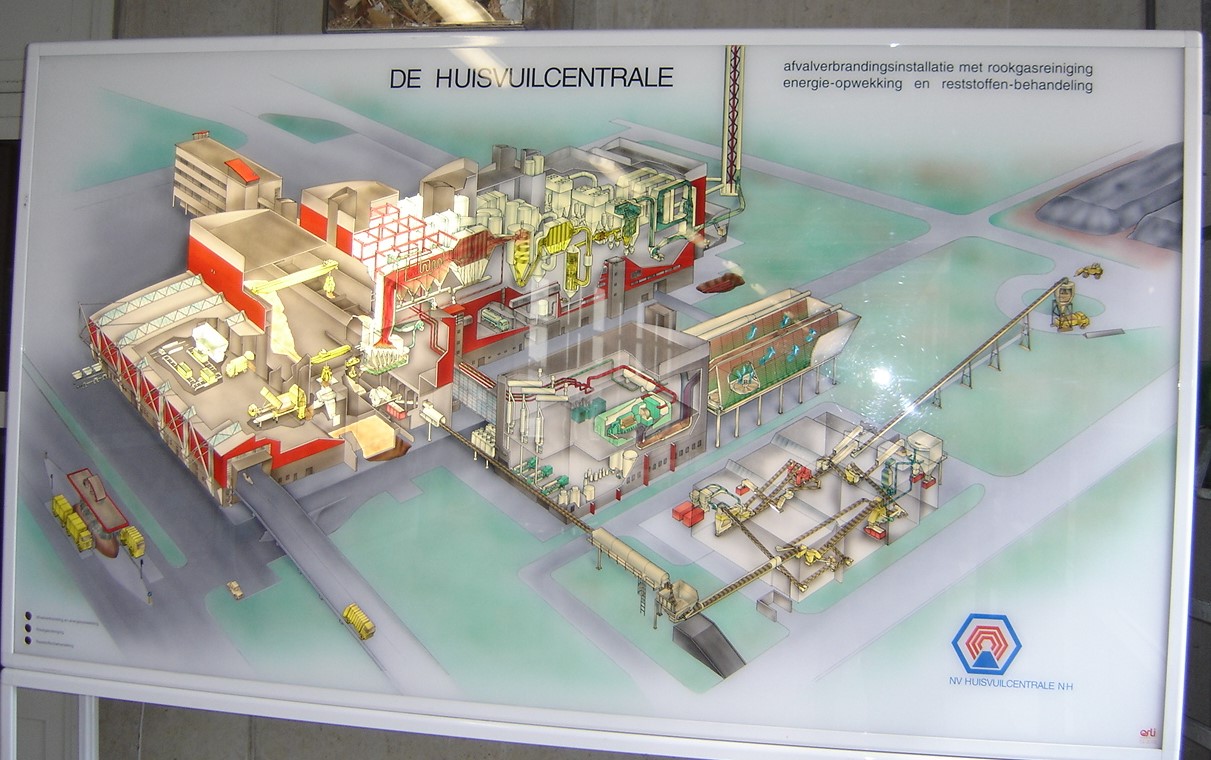

Information Board outlining internal workings of Dutch EfW Plant.

Trade press reports that moves by the Dutch government to tackle climate change may include a tax on the import of refuse derived fuel (RDF) which could have major impacts on the cost of residual waste disposal for businesses and councils in the UK.

Members of the Dutch parliament are meeting later today (3 July) to discuss the Netherlands’ National Climate Agreement, which was outlined by the Minister of Economic Affairs and Climate Policy, Eric Wiebes, last week.

The National Climate Agreement follows the conclusion of the Urgenda court ruling. This is forcing the Dutch government to take more stringent action to reduce greenhouse gas emissions by the end of the decade.

Late yesterday evening it emerged that the proposals are likely to include the potential for a tax on the imports of ‘foreign waste’, with a knock-on effect on the trade in RDF from countries such as the UK.

The Environmental Services Association (ESA), which represents UK waste management businesses, has written to Dutch MPs to express its concerns at the proposed tax. It described the measure as potentially ‘crippling’ to the UK waste management industry.

Its letter sent late yesterday, said: “We are currently experiencing an under capacity of residual waste treatment which is expected to continue even as we meet 65% municipal recycling.”

“Given that new EfW plants have a long lead-in time, the introduction of the proposed tax would be crippling to the UK waste management industry and local authorities who will have no other option in the short-medium term than to landfill their residual waste at great environmental cost.”

The National Association of Waste Disposal Officers (NAWDO) has also written to the Dutch House of Representatives saying

“Your tax proposal will directly lead to higher expenditure by UK local authorities during uncertain economic times, endangering the livelihood of the communities they serve. Government budget austerity and savings are still very serious issues for all UK local authorities and increased expenditure on waste management will simply lead to undesirable reductions to other sensitive budgets managed by local authorities. Even those authorities which do not export waste will see increased waste treatment and recycling charges due supply and demand issues for example 1.7Mt of waste filling up whatever available capacity there is in the UK.”

Regardless whether the Tax will be applied or not by the Netherlands Government, it further highlights some of the risks of dependency in services heavily reliant on external export markets and goes to further enhance self-sufficient solutions.